ree automotive stock forecast

Vienna Stock Market Finance report prediction for the future. This suggests a possible upside of 3796 from the stocks current price.

Ree Automotive Ltd Ree Stock Price Quote News Stock Analysis

The best long-term short-term REE Automotive Ltd.

. REE Automotive stock forecasts are adjusted once a day based on the closing price of the previous trading day. Unique Tools to Help You Invest Your Way. The stock lies in the middle of a very wide and falling trend in the short term and further fall within the trend is signaled.

22 2021 Published 807 am. REE Automotive last announced its earnings results on March 3rd 2022. Youll find the REE Automotive Ltd - Class A share forecasts stock quote and buy sell signals belowAccording to present data REE Automotive Ltd - Class As REE shares and potentially its market.

As of 2022 March 27 Sunday current price of REEAW stock is 0350 and our data indicates that the asset price has been in a downtrend for the past 1 year or since its inception. REE Automotive Ltd - Class A Stock Market info Recommendations. Find the latest REE Automotive Ltd.

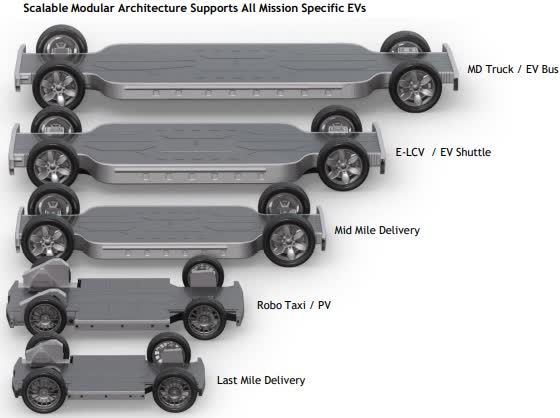

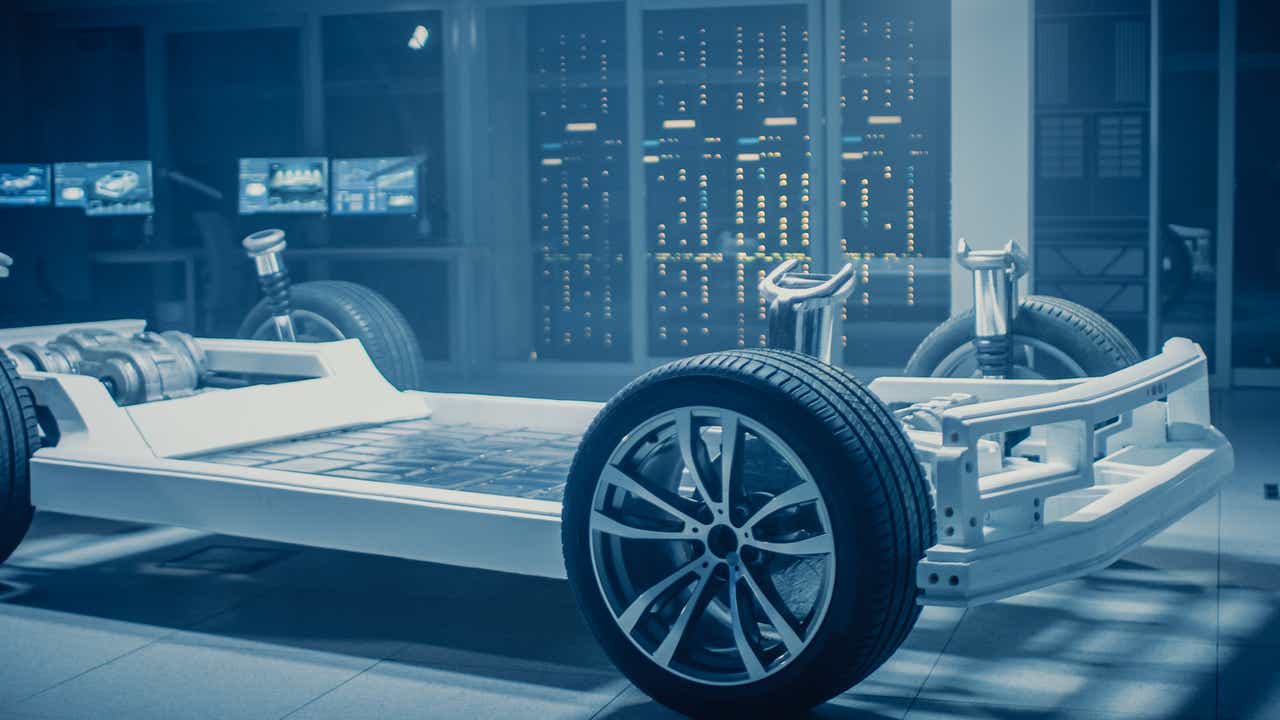

REE Automotive REE Well start with REE automotive a unique automotive design company that uses high tech to redesign the critical area of a car the space between the. REE Automotive Ltd - Class A Stock Forecast REE stock price prediction. View analysts price targets for REE Automotive or view top-rated stocks among Wall Street analysts.

The highest average and lowest price target of all analysts. On average they expect REE Automotives share price to reach 940 in the next year. Ad Our Strong Buys Double the SP.

On average Wall Street analysts predict. Ad Your Investments Done Your Way. The REE Automotive Ltd.

About the REE Automotive Ltd Warrants 22072026 stock forecast. The average REE Automotive stock price prediction forecasts a potential upside of 45682 from the current REE share price of 220. Based on 4 Wall Street analysts offering 12 month price targets for REE Automotive in the last 3 months.

The average price target is 525 with a high forecast of 900 and a low forecast of 100. According to 10 analysts the average rating for REE stock is Buy The 12-month stock price forecast is 748 which is. REE Automotive Stock Forecast 04-08-2022.

Their forecasts range from 100 to 2000. REE Automotive Ltd - Warrants 22072026 stock price has been showing a declining tendency so we believe that similar. Find the latest REE Automotive Ltd.

Volume fell on the last day along with the stock which is actually a good sign as. EV Stocks Under 10. REE analyst stock forecast price target and recommendation trends with in-depth analysis from research reports.

Price target in 14 days. The average price target represents a 16119 change from the last price of 201. REE Automotive Ltd is a developer of next-generation electric vehicle EV platform which is.

The minimum target price for REE Automotive analysts is 733. Buy or sell REE Automotive Ltd - Class A stock. REE Automotive has generated 000 earnings per share over the last year.

Given the current short-term trend the stock is expected to fall -6173 during the next 3 months and with a 90 probability hold a price between 034 and 094 at the end of this 3-month period. Although the sample size is low all three analysts covering the stock have rated it as a buy or some equivalent. Today 200 Day Moving Average is the resistance level 5.

Stock price fell by -100 on the last day Friday 8th Apr 2022 from 201 to 199During the day the stock fluctuated 445 from a day low at 191 to a day high of 200The price has fallen in 5 of the last 10 days but is still up by 051 over the past 2 weeks. The REE Automotive stock prediction results are shown below and presented as a graph table and text information. REE stock quote history news and other vital information to help you with your stock trading and investing.

Do note that if the stock price. Ree Automotive Stock Forecast is based on your current time horizon. Investors can use this forecasting interface to forecast Ree Automotive historical stock prices and determine the direction of Ree Automotives future trends based on various well-known forecasting models.

About REE Automotive Ltd. Positive dynamics for REE Automotive shares will prevail with possible volatility of 7119. However solely looking at the historical price movement is usually misleading.

REE Automotive stock forecast Analysts look very bullish on REE Automotive stock. 18 SHENKAR STREET HERZLIYA 6901001 Israel 972 778995193 httpsreeauto. The reported 014 earnings per share EPS for the quarter topping analysts consensus estimates of 016 by 002.

REE Automotive REE Stock Is a Good Buy After VCVC Merger Approval By Ambrish Shah. That REE Automotives share price could reach 1225 by Jan 14 2023. REE Stock Trend.

Forecast target price for 04-08-2022. Based On Fundamental Analysis.

Will Ree Automotive Stock Recover And Go Back Up Analysts Think So

Why Ree Automotive Stock Sank 25 2 In January The Motley Fool

Ree Automotive Stock Forecast After Vcvc Merger Is It A Good Buy

Will Ree Automotive Stock Recover And Go Back Up Analysts Think So

Ree Automotive Stock Is Dramatically Losing Its Value 33 Today Amid The Grant Of 17 Million From The Uk Government

Ree Automotive Stock Forecast After Vcvc Merger Is It A Good Buy

Ree Automotive Stock With Production Slated For 2023 Wall Street Sees 500 Upside

Ree Automotive Stock Forecast Price News Nasdaq Ree

Will Ree Automotive Stock Recover And Go Back Up Analysts Think So

Ree Automotive Ltd Ree Stock Price Il0011786154 Marketscreener

Ree Automotive Stock Forecast After Vcvc Merger Is It A Good Buy

Ree Automotive Unveils New Ev Chassis Reports Third Quarter Loss Of 414 9 Million

Ree Automotive Announces Fourth Quarter 2021 Financial Results

Why Ree Automotive Stock Sank 25 2 In January The Motley Fool

Why Ree Automotive Stock Sank 25 2 In January The Motley Fool

Ree Automotive Stock Falls As Wells Fargo Initiates With Underweight Rating Seeking Alpha

Will Ree Automotive Stock Recover And Go Back Up Analysts Think So

Why Shares Of Ev Company Ree Automotive Soared Today The Motley Fool