owner's draw vs salary

It should however be remembered that the IRS requires owners of S corporations to be paid reasonable compensation if they also act as officers andor employees of the company. Instead of taking a draw the amount of which can vary per draw you can choose to take a salary instead.

Also Interesting Men Vs Women Man Vs Infographic

Business owners can choose to pay themselves via an owners draw or a salary or a combination of both.

. You dont need a salary because you have the flexibility to increase and decrease your draw depending upon your wants and needs. Here is her partner equity balance after these transactions. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

In the latter method you take a salary just as any other employee. Taking Money Out of an S-Corp. On the other hand a payroll salary offers more stability and less planning at the expense of less flexibility.

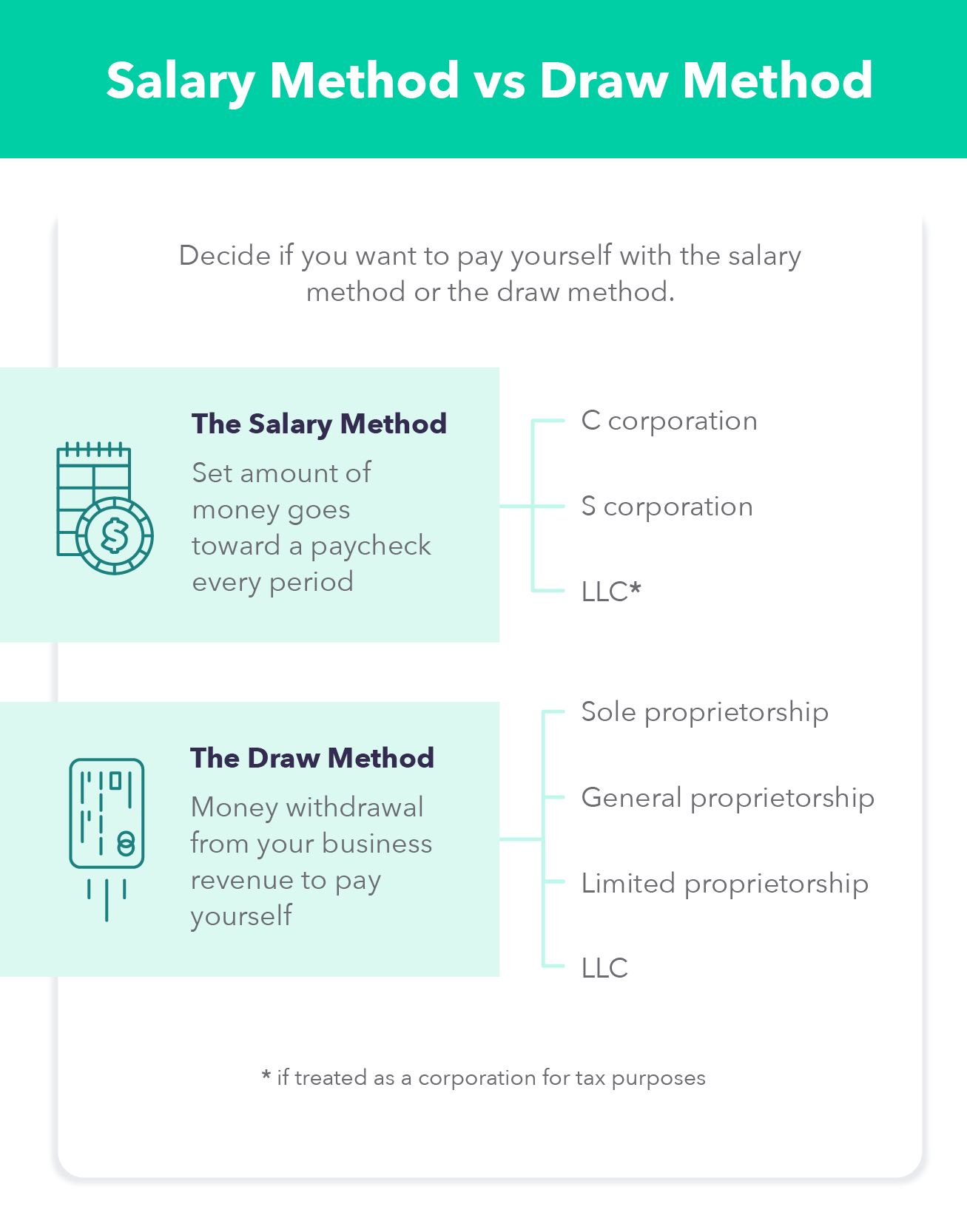

Keep in mind that a partner cant be paid a salary but a partner may be paid a guaranteed payment for services rendered to the partnership. Draws can happen at regular intervals or when needed. The draw method and the salary method.

Many small business owners compensate themselves using a draw rather than paying themselves a salary. Here is her partner equity balance after these transactions. An owners draw simply means that you draw money either cash or means from your business profits on an as-needed basis.

If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000. A company owners salary works pretty much in the same way that a regular employees salary doesyou decide on your wages and you give yourself a paycheck every pay period. First lets take a look at the difference between a salary and an owners draw.

Salary is the recurring payment that you receive every month just like an employee. You can pay yourself from an LLC in the form of salary or the owners draw. Here is a definition of each method.

With the draw method you can draw money from your business earning earnings as you see fit. Difference Between Owners Draw and Salary. Patty could withdraw profits generated by her business or take out funds that she previously contributed to her company.

The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Owners draw vs salary. Rather than having a regular recurring income this allows you to have greater flexibility and adjust how much money you get depending on how.

Paying yourself a salary is an ideal option if a certain amount of income is required each month to meet your personal needs. When you pay yourself a salary you decide on a set wage for yourself and pay yourself a fixed amount every time you run payroll. Suppose the owner draws 20000 then the owners equity is reduced to 28000.

Owners draws can be scheduled at regular. While there are other ways business owners pay themselves an owners draw or a draw and taking a salary are the two most common. As long as you keep your personal and business expenses separate ideally using separate bank accounts youre good.

70000 contributions 30000 share of profits 15000 owners draw 85000 partner equity balance. An owners draw refers to an owner taking funds out of the business for personal use. When choosing owners draw.

Since owner draws are discretionary youll have the flexibility to take out more or fewer funds based on how the business is doing. In the former you draw money from your business as and when you see fit. Its the amount an owner invested and profits that the business made thanks to the investment.

Clients and customers pay you you pay taxes done and done. If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. Your two payment options are the owners draw method and the salary method.

The business owner takes funds out of the business for personal use. Salary method vs. When you do business in your own name as a sole proprietorship there isnt really such a thing as a salary or a distribution.

There are two main ways to pay yourself. A salary on the other hand is a set recurring payment that youll receive every pay period that includes payroll tax withholdings. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

You can also receive the owners draw. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. 70000 contributions 30000 share of profits - 15000 owners draw 85000.

Draws can happen at regular intervals or when needed.

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks

Progressive Invoices Quickbooks Create Invoice Sample Resume

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

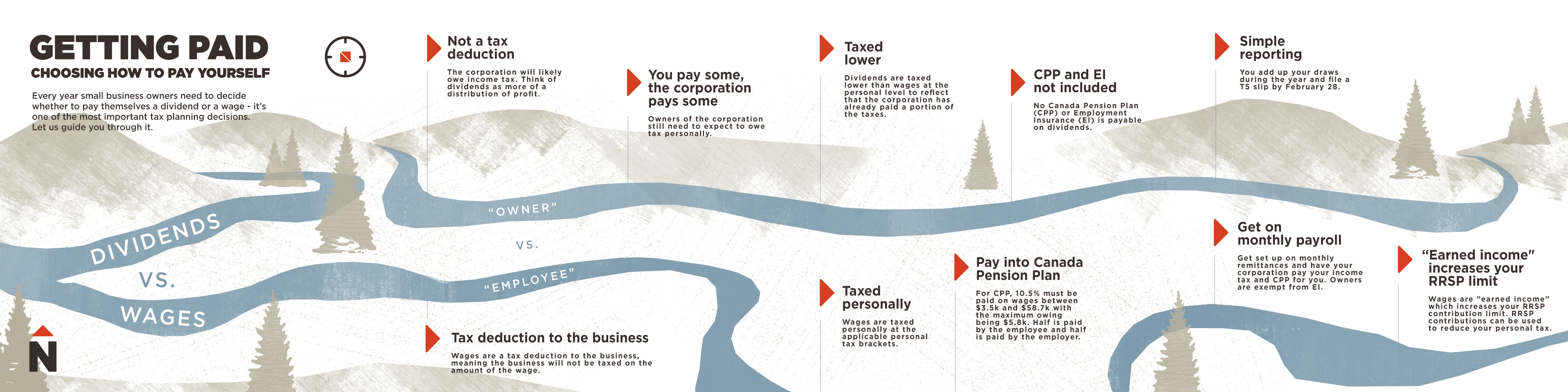

How To Pay Yourself Dividends Vs Wages Olympia Benefits

How To Pay Yourself Dividends Vs Wages Olympia Benefits

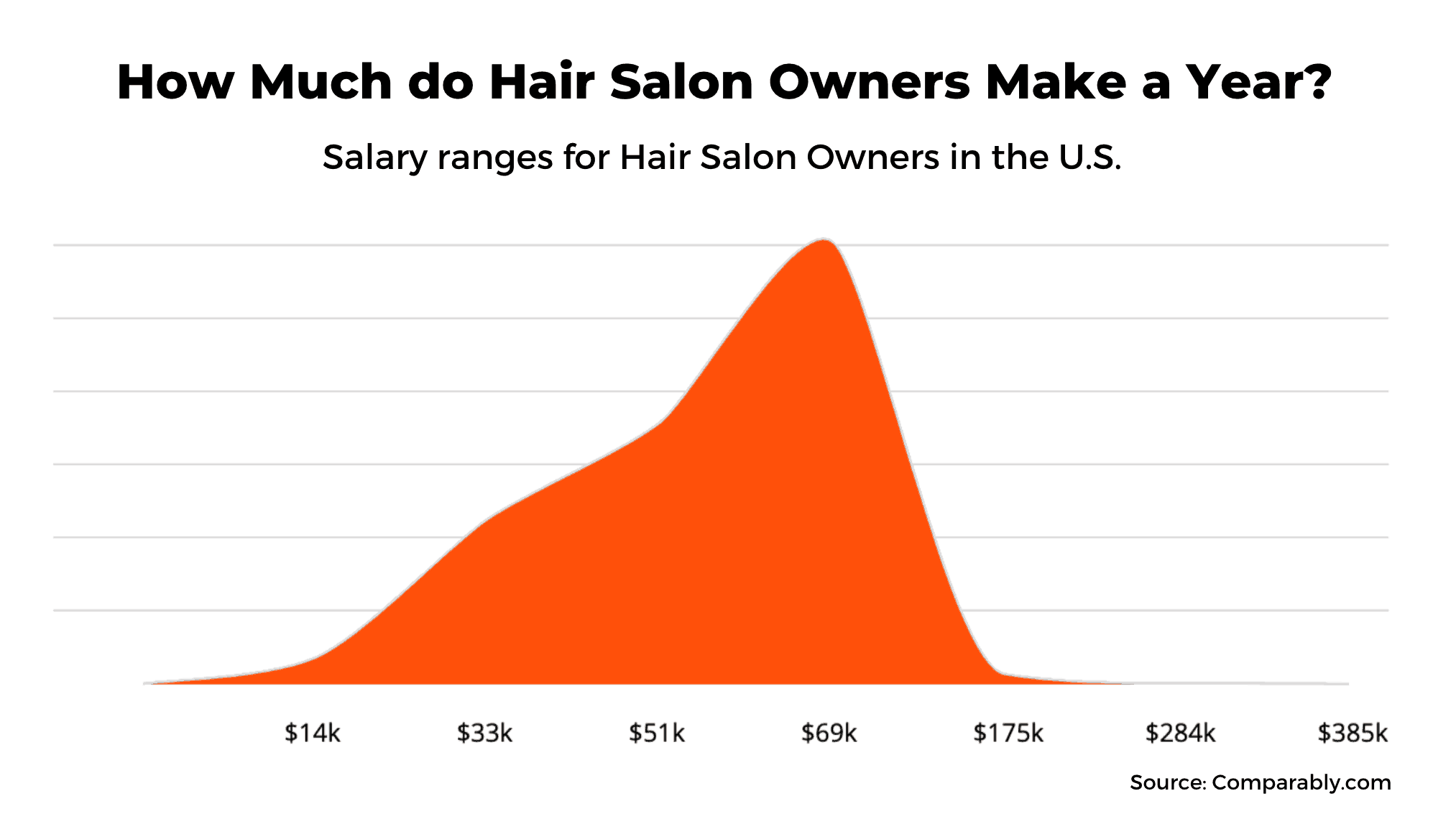

How Much Do Salon Owners Make And How Do You Earn More

Whitepaper Interactive Content Strategy For Ecommerce Businesses Content Strategy Whitepaper Interactive

Owner Draw Vs Salary Paying Yourself As An Employer

Salary Vs Draw How To Pay Yourself As A Small Business Owner

Stephen L Nelson S Small Business Tax Deduction Secrets Ebook Tactics And Tricks F Small Business Tax Deductions Business Tax Deductions Small Business Tax

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Are You New To Tracking Reviewing And Reporting Your Business S Finances Find Out How To Set Up Accounting B Accounting Books Accounting Accounting Training

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

Entrepreneur Salary 5 Steps To Paying Yourself First Mintlife Blog

Dashboard For A Product Management Product Project Management Tools States Project Project Management