do you pay taxes when you sell a car in texas

You have to look at the whole picture Steber says. You generally wont pay any gift tax either.

Which U S States Charge Property Taxes For Cars Mansion Global

In this scenario youre not walking away with cash for the value of your old car.

. As you can see when you sell your property you effectively give back the depreciation deductions you took on it. Normally if you fail to pay your property tax your house can be seized by the government and sold at auction. However the government will not ask you to pay this tax if you received the vehicle as a gift.

If you qualify for these protections your home is protected from seizure even if you do not pay your property tax. If youre already facing a property tax sale in Texas and have questions or need help redeeming your property consider talking to a foreclosure lawyer tax lawyer or. If you owe more on the car than its worth however the dealer may offer to add that leftover amount to your new loan.

But Texas actually provides special protections for elderly and disabled homeowners. The amount of your gain attributable to the depreciation deductions you took in prior years is taxed. Rather the amount you get after any outstanding car loans are paid off is applied toward the cost of your new car reducing the amount youll have to pay.

The donor not the recipient is reponsible for paying gift tax where the value of the gift exceeds a certain value. Thus Violas taxable gain was increased by the 43000 in depreciation deductions she took. Taxes are simply never.

If youre having trouble paying your property taxes you might be able to reduce your tax bill or get extra time to pay. If the donor stays below the annual exclusion. If you are 62 or older you can opt to take out a reverse mortgage which allows you to convert part of the equity in your home for cash that you can use to help pay for living expenses.

The loan has to be repaid when the borrower dies sells the home or no longer lives in the home as a principal residence. Since they reduce your adjusted basis they increase your taxable gain. Start with your own simple analysis and have a tax pro kick the tires.

When you purchase a new or used car you will usually pay sales tax.

Texas Car Sales Tax Everything You Need To Know

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

The 17 Reasons Tourists Love Used Car Attorney Texas Used Car Attorney Texas Used Cars Car Accident Lawyer Cameron County

If I Sell My Car Do I Pay Taxes All You Need To Know About Taxes When Selling A Vehicle

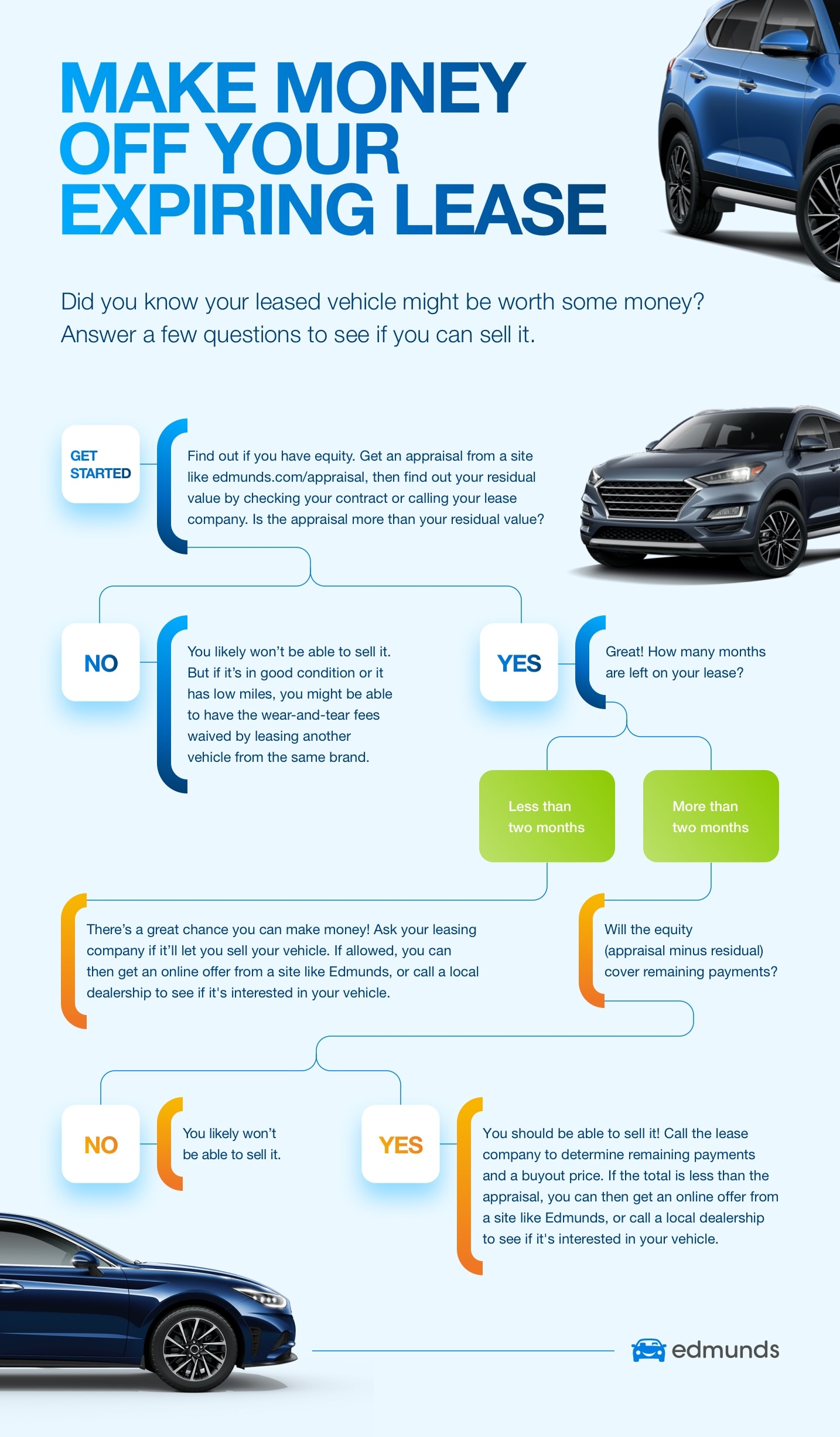

Consider Selling Your Car Before Your Lease Ends Edmunds

What S The Car Sales Tax In Each State Find The Best Car Price

Texas Used Car Sales Tax And Fees

Trade In Car Or Sell It Privately The Math Might Surprise You